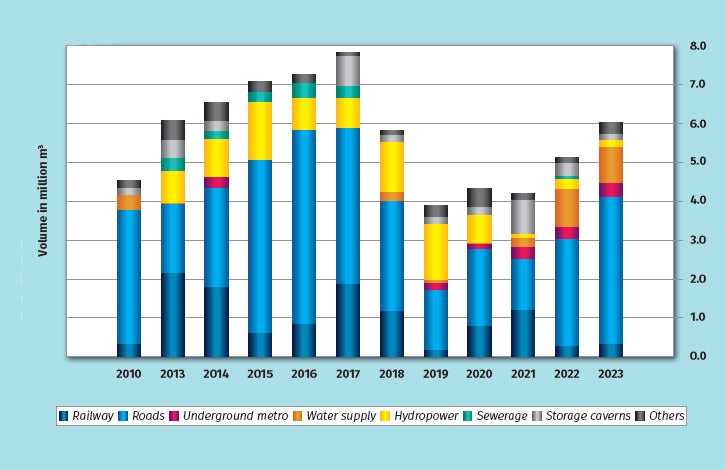

Tunnelling in Norway is dominated by Drill & Blast method and activity overall in 2023 extended the trend of annual increases, according to the latest national figures from the Norwegian Tunnelling Society (NFF – Norsk Forening for Fjellsprengningsteknikk).

The additional nudge up takes last year’s total tunnelling activity in Norway beyond historic highs enjoyed a few decades ago (1977 – 1998) to edge into the overall levels last seen in the most recent, and largest ever, peak period (2012-2018). Last year was on par with activity levels in each of 2012 and 2013, and slightly more than 2018. Only four years had higher tunnelling activity – 2014-2017.

The increase in the 2023 activity levels over 2022 comes primarily from the transport sector which, generally in Norway, concerns roads – which quite often feature road tunnels in the mountainous country.

This more than offset the dips in hydropower and storage cavern excavations year-on-year, although another factor marginal giving a slight boost was metro tunnels. Water supply tunnelling activity held level.

The last peak period (2012-2018) had activities mostly comprising tunnels for road, rail and hydropower, whereas the makeup more recently is roads primarily and also water. plus small amounts of rail and metro tunnels, respectively, and a little of hydropower.

Much of Norwegian tunnelling is hard rock tunnelling by Drill & Blast method, as noted. The 1970s and 80s saw some TBM tunnelling, which after an interlude reappeared a few years ago across a number of projects utilising large machines, as the technology had moved on.

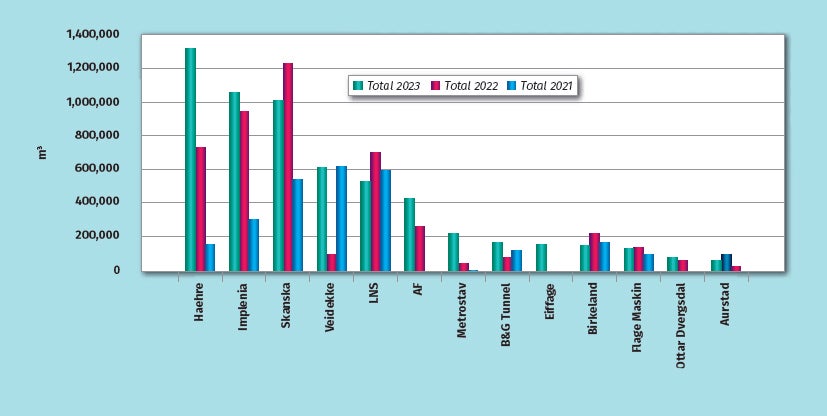

CONTRACTORS

The contractors most active in tunnelling production in Norway in 2023, according to the NFF annual data, were (in order Haehre, Implenia, Skanska, Veidekke, LNS, AF, Metrostav, B&G Tunnel, and Eiffage.

Most contractors had higher underground excavation output in total cubic metres than in 2022, except for Skanska and LNS, both of which saw declines on the prior period.

Veidekke had experienced a big drop in total tunnelling activity from 2021 levels into 2022 and level has been regained, taking it into fourth place in 2023. It was much further down the rankings in 2022.

But it is Haehre that has significantly added to its tunnelling activity year-on-year since 2021, enabling it to move up from third ranked position in 2022 to be the pack leader in 2023.

The former leader was Skanska, which remained very active in tunnelling output last year but at a slightly lower level than 2022, and with others increasing their share of the work that put it into third place – effectively swapping position with Haehre.

Between them, in second place, was and remains Implenia which had another year of increased activity though not as markedly a step-up as from 2021 to 2022.

But enough to, just, be ahead of Skanska in 2023. In fifth place last year was LNS, moving down one place after a slight decline in activity.

Last year’s sixth place was– and continues to be – held by AF, which had a further increase in activity. Metrostav was seventh place, moving a number of places up the table.

Eiffage has come onto the scene, slightly edging ahead of Birkeland which saw a dip in activity after a slight rise from 2021 into 2022.