The global pipeline of tunnels-related projects is dominated by Western Europe and North-East Asia, by value. Combined, North and Latin America hold joint fourth place in the rankings, about on par with the activity in the Middle East and North Africa (MENA). The Americas and MENA are behind the region ranked third place, Australasia.

Latin America’s tunnels-related projects are, by value, about one quarter of that of North America. That activity is only about one tenth of either of the joint leaders, Western Europe and North-East Asia. Like those leading regions, though, the project pipeline in Latin America has most development activity in the Execution stage.

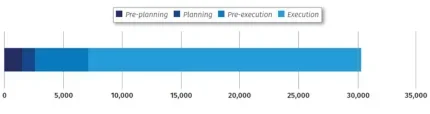

By value, Latin America has just over US$30 billion in tunnel-related projects at various stages of development, according to GlobalData’s latest quarterly analysis – ‘Project Insight: Global Tunnel Construction projects, Q1-2025’.

For large projects, where data on underground works elements aren’t available to consider separate to other construction works, the methodology of the analysis is to consider the whole value of projects. In absolute terms, therefore, the project pipeline value for tunnel works along – at whatever stage of development, design to excavation – is less that the figures listed given. They are qualified as ‘tunnels-related’ projects.

Transport projects are the main focus on the tunnels-related project investments in the region, and most activity is in Rail & Metro. As noted, the later stages of project development – Pre-Execution and Execution, respectively – account for most of the value share.

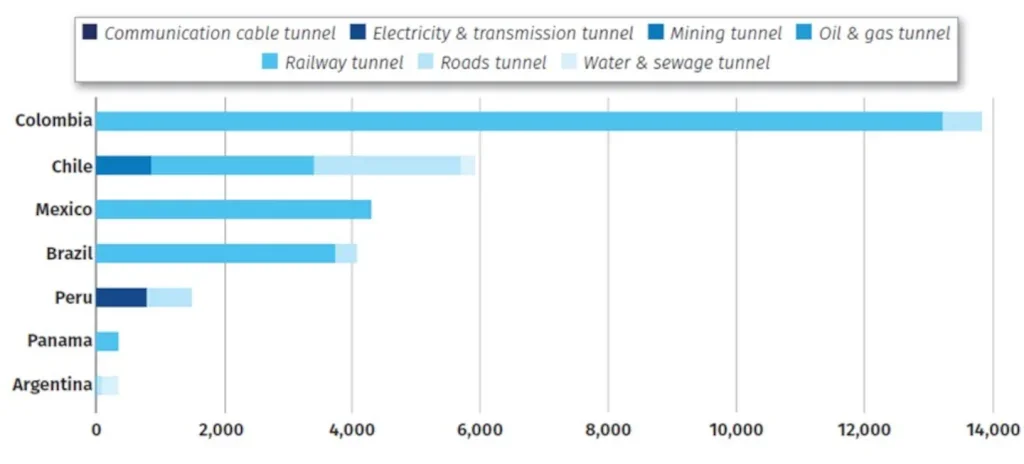

Nationally, the investment leader in tunnels-related projects in the region is Colombia, by quite a margin.

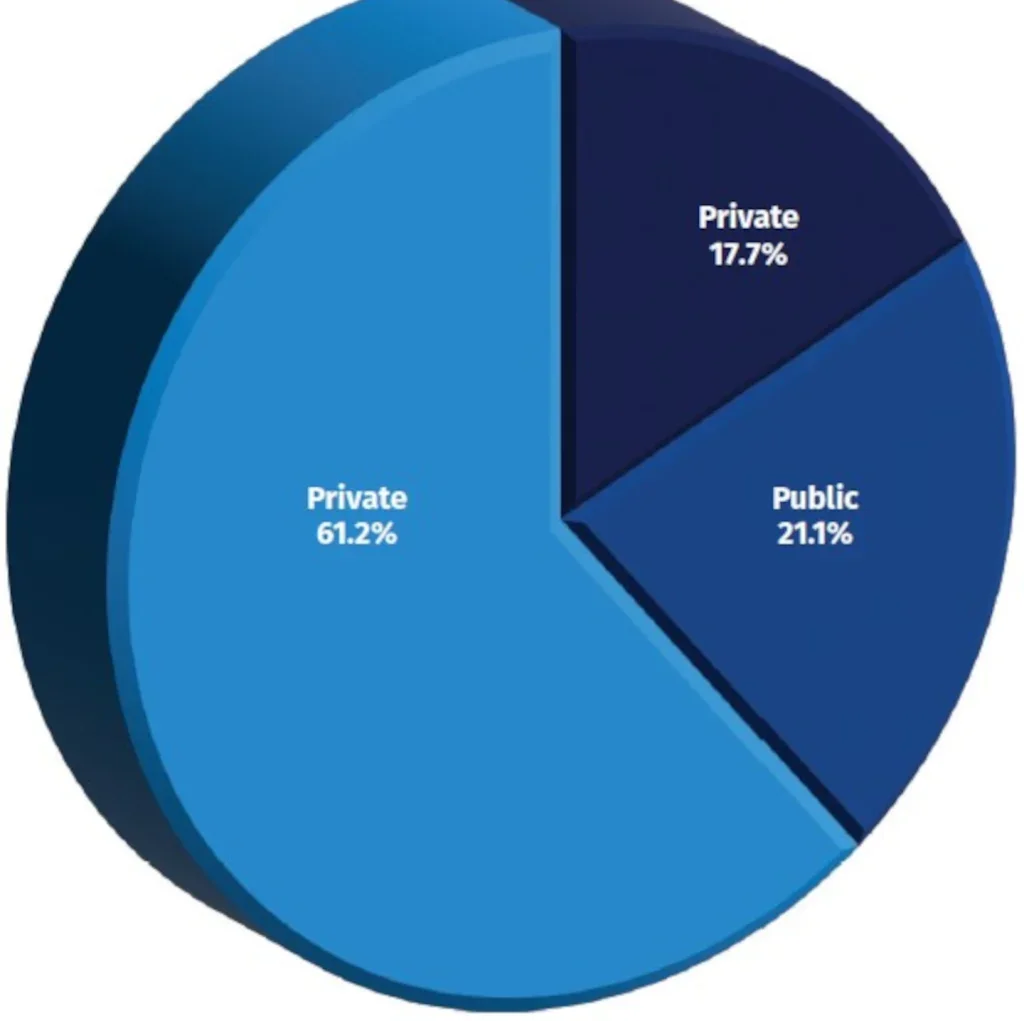

Overall, the region’s funding of the tunnels-related projects has Public-Private holding the largest share, although that mode is not used in three countries – Mexico, Peru and Argentina.

STAGES

By far the majority of tunnels-related projects in the region, by value, are in the final, Execution stage of development, according to GlobalData’s Q1 analysis. There is US$23.2 billion, or slightly mover 76%, of the project pipeline in the Execution stage.

In comparison, the shares of the project pipeline held by the other development stages are much smaller, holding less than a quarter of the total value between them. In breakdown, they are Pre-Execution (US$4.5 billion, or 15%) and Pre-Planning (5%) and Planning (4%).

Overall, Q1 activity shows that with the late-stage weighting there is far less in early development to come through as future construction works than presently underway, advancing to completion. This weighting is set to continue over the next few years but with some increase in early stage activity adjusting the balance a little.

Even Colombia, the nation with most tunnels-related projects by value, has this weighting – but even moreso; according to the Q1 analysis there is a lack of early stage activity in the country. The same is so for Mexico, Panama and Argentina. Only Chile, Peru and Brazil are noted to have early stage activity in the project pipeline.

By nationally, the project pipeline is led by Colombia (US$13.8 billion, or 45% share), followed by Chile (US$5.9 billion, 19%), Mexico (US$4.3 billion, 14%), and Brazil (US$4.1 billion, 13%).

SECTORS

In terms of sector activity, the Q1 analysis show that most of the tunnels-related projects in the region, by value, are in Transport – primarily Rail & Metro (especially the latter), and also some in Highways & Roads.

Project activity in Colombia is dominated by Transport, and mostly Rail & Metro, concerning the metro system in Bogota.

Rail & Metro is also the majority project pipeline activity, by value in Q1, in Mexico and Brazil, and leads, just, in Chile where there is also Road sector works.

Across the region there is, in relative terms, and perhaps by its local nature, only minor shares of project activity in Water & Sewerage tunnels-related projects.

Hydropower and mining tunnels are also part of activities in the region, in Peru and Chile, respectively.

FUNDING

As noted, for Latin America as a whole the largest share of funding of the tunnels-related projects is Public- Private mode, at 61.2%, in GlobalData’s Q1 analysis.

The other two funding modes – Public and Private – are far less although still substantial, at 21.1% and 17.7%, respectively.

Among the nations of Latin America with tunnelsrelated projects, as listed in GlobalData’s analysis, Public-Private mode of funding is predominant in Panama (100%), Brazil (92.5%), Chile (81.7%), and Colombia (69.5%).

Public-Private mode is not used in Mexico, Peru and Argentina, as previously noted. Instead, the funding modes in those nations lean as follows: Mexico and Peru – both entirely Public mode; Argentina is mostly Public mode (85.2%).

Private mode is the following shares: Colombia (30.5%); Chile (18.3%); and, Argentina (14.8%).