TUNNEL VISION GUIDES REGION

Gulf cities are buzzing with economic growth. Populations are growing, real estate values are rising and project activity is ramping up as developers launch real estate projects.

From a construction point of view, economic success is best represented by the high-rise towers stretching across the skylines that now define the region’s modern urban identity.

While towers continue to be developed, how Gulf cities perform in the future will depend more on what is built below the ground rather than above it.

As buildings have become taller, population densities have increased, putting huge pressure on infrastructure networks. This is most apparent on the roads, with cities blighted by crippling traffic in peak periods.

More investment in infrastructure is needed to overcome this challenge, and crucially, with space on the surface limited, the solution is to build more roads and utilities networks underground. This has been done before with projects such as the metros in Dubai, Doha and Riyadh, and the deep gravity sewerage network built in Abu Dhabi, and in each case, demonstrating the value of underground infrastructure.

Emboldened by these successes, the region is working on a new generation of tunnelling projects. Dubai’s proposed Loop system, backed by Elon Musk’s Boring Company, is one of the highest-profile examples of this trend. Others include projects such as the Riyadh Metro Line 7, the Blue and Gold lines for Dubai Metro, along with ongoing metro projects in Cairo.

The momentum in the Middle East comes amid growing pressure on global investment in tunnelling due to economic headwinds, inflation and geopolitical tensions.

Although the Middle East is not immune to global trends, its growing cities, combined with the means and the desire for them to become the world’s best cities in the future, will mean that the region will remain a bright spot for tunnelling for the foreseeable future.

MUTED PUBLIC SPENDING HINDERS GLOBAL TUNNELLING

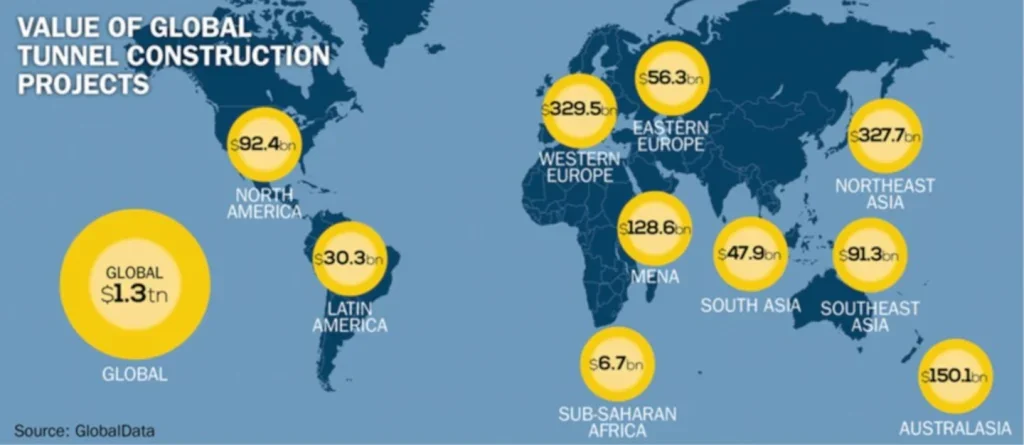

The pipeline of tunnel construction projects around the world as tracked by GlobalData stands at US$1,300 billion, encompassing projects from announcement to execution.

The total pipeline value reflects the overall values of projects that are either entirely tunnels or that have tunnels as an integral part of the work. The project pipeline includes tunnelling works across a range of sectors, including road and railway development, as well as water and sewerage.

Subdued spending

Public spending is anticipated to remain muted globally in the short term, as governments are still trying to curtail expenditure to reduce public debt, thereby constraining investments in public infrastructure. This is affecting the demand for tunnel construction, which heavily relies on public infrastructure development. Elevated construction material prices, high interest rates and labour and skill shortages are expected to discourage new investment, further reducing demand for tunnel construction.

These challenges have already impacted project viability, leading to the withdrawal or postponement of funding for 50 projects in Australia’s US$78.6 billion infrastructure investment programme due to cost increases of over US$21 billion. The conflicts in Russia and Ukraine, the situation in Gaza and disruptions to shipping in the Red Sea are weighing on new investment levels, particularly in Eastern Europe and the Middle East and North Africa (Mena) region due to increased uncertainty.

However, this decrease in new tunnel investment is not expected to be uniform globally, as China’s significant infrastructure investment drive, the US’ Infrastructure and Jobs Act, and India’s various infrastructure investment programmes are driving new investment in their respective regions (see box panel: Global Regions: Project Pipeline Snapshot).

TRAFFIC DRIVES CONSTRUCTION UNDERGROUND

In February, Dubai construction was thrust again onto the global stage when Elon Musk, the world’s richest man, announced plans to explore the development of an underground Dubai Loop transportation system, along the lines of the Las Vegas Convention Center Loop project, in the US.

Dubai has typically made headlines globally by constructing the world’s tallest towers. As the city becomes increasingly congested on the surface, it is taking some of its largest construction projects underground.

With Musk’s backing, the Dubai Loop scheme is the most highprofile tunnelling project launched to date. It involves carving a futuristic transport system underneath Dubai. The initial phase of the project is currently being studied by Dubai’s Roads & Transport Authority (RTA) in partnership with The Boring Company, which is owned by Musk. It will cover 17km and have 11 stations, with the capacity to transport over 20,000 passengers an hour.

The project highlights the importance of expanding underground infrastructure in the Middle East region. This is mostly necessitated by the pressure that rapidly growing cities have put on existing transport and utility networks, particularly in major urban centres such as Dubai, Riyadh and Doha.

Underground opportunities

Projects that involve tunnelling, such as metro rail systems, underground highways and pedestrian walkways, are deemed key enablers in reducing congestion and optimising land use.

The recently completed metro systems in Riyadh and Doha are examples of how underground rail networks can facilitate efficient urban mobility, and more such schemes are planned.

Without these subterranean projects, cities risk being stuck in a permanent state of gridlock, with longer commute times and decreased productivity. At the same time, tunnelling allows urban planners to integrate sustainable transport solutions, as well as large-scale utilities networks, without disturbing existing cityscapes, thereby enhancing connectivity and economic growth.

These developments signal a major shift in engineering priorities, with regional governments investing in underground transport, sewerage and metro extensions to accommodate their growing populations and infrastructure needs.

While the tower crane-dotted skylines of urban centres in the Gulf Cooperation Council (GCC) countries attract attention, delivering major projects underground is an equally impressive engineering feat. Tunnelling under busy cities requires advanced excavation techniques, careful planning and coordination to avoid disruptions.

UAE tunnelling projects

Tunnelling work forms a significant portion of the Dubai Metro Blue Line extension. Awarded in December for AED20.5 billion (US$5.5 billion), the project includes 15.5km of underground track and five subterranean stations. When operational in 2029, the Blue Line will significantly expand Dubai’s metro capacity, linking major residential and commercial hubs.

More tunnelling work is expected as Dubai takes another significant step forward in tackling its traffic problems by starting the procurement process for its next metro link: the Gold Line.

Although the technical details of the project have yet to be revealed, it is expected that tunnels will form a major component of the scheme given that the new line will run through busy urban areas where there is little space to build overground.

The Gold Line will start at Al-Ghubaiba in Bur Dubai. It will run parallel to – and alleviate pressure on – the existing Red Line, before heading inland to Business Bay, Meydan, Global Village and residential developments in Dubailand.

As a first step, the RTA has sent a request for proposals to companies for the lead consultancy role on the multibillion-dollar project.

The UAE’s Etihad Rail also began a study of the tunnels required for the high-speed railway line connecting Abu Dhabi and Dubai in January. The survey works are ongoing on the Jaddaf and Dusup tunnels that will serve the high-speed rail link. Initial plans for the project include tunnelling works totalling 31km.

Another major tunnelling project in the UAE is the US$22 billion Dubai Strategic Sewerage Tunnels scheme. The client, Dubai Municipality, is preparing to tender its first packages, which include deep tunnels that will stretch 42km in Jebel Ali and 16km in Warsan.

The project will be delivered under a public-private partnership (PPP) model, with international consortiums competing for contracts.

Once completed, these tunnels will replace the traditional wastewater network, reducing energy consumption and enhancing long-term sustainability.

Saudi schemes

In Saudi Arabia, Riyadh is preparing to expand its metro network with the addition of a Line 7 and an extension to the existing Line 2.”

The total length of Line 7 will be about 65km, of which 47km will be underground. The line will have 19 stations, 14 of which will be underground.

The project involves constructing a metro line linking the Qiddiya entertainment city development, King Abdullah International Gardens, King Salman Park, Misk City and Diriyah Gate.

In March, the Royal Commission for Riyadh City (RCRC) gave consortiums mid-June to submit their bids for a Design and Build contract for the construction of Line 7.

The planned Line 2 extension is 8.4km long, of which 7.1km is underground, and three out of its five stations will be built underground. The RCRC is expected to award the construction contract this year.

In January, the kingdom also completed the phased roll-out of the Riyadh Metro network. The current network comprises six lines spanning about 176km, of which 74km is constructed underground.

These numbers indicate that over 42% of the overall network is underground, highlighting the growing importance of tunnels in the kingdom’s plans to improve infrastructure in its most densely populated cities.

Tunnelling works are also a key component of the plans to improve the stormwater drainage system in Jeddah, where the municipality is preparing for the construction of the King Abdullah Road-Falasteen Road tunnel.

The three-year scheme involves constructing 5.3km of 7.2m i.d. tunnels using tunnel boring machines (TBMs) and another 3.4km of tunnels of 3.5m diameter driven by either pipejacking or TBM method.

At the kingdom’s Neom gigaproject, city planners are looking to find solutions to many of the problems faced in existing cities and, as a result, tunnels and large-scale underground utilities corridors are being built at the beginning of the project. For example, the development’s Delta Junction tunnels will serve as a railway junction connecting the Spine infrastructure corridor with the Neom Connector rail link to the Oxagon industrial zone.

The project involves 26.5km of tunnelling work that will be split into a north and a south lot. The construction works are expected to begin this year as the client is evaluating the revised proposals submitted by firms in late 2024.

Further tunnel projects

Beyond the Gulf, Egypt has a long history of tunnelling projects, as it has had to deal with crippling congestion and urban overcrowding for decades. In the 1980s, work was completed on two major projects that involved tunnelling: the first phase of the Cairo Metro system and the Greater Cairo wastewater project, which involved the construction of sewage tunnels on the east and west banks of the Nile.

Today, Cairo’s tunnelling projects include the Cairo Metro Line 4 project. Spanning 42km with 39 stations, it involves over 20km of tunnels.

Meanwhile, in Morocco, national railway operator L’Office National des Chemins de Fer (ONCF) is constructing a tunnel project in Rabat.

In February, ONCF announced a 3.3km-long tunnel to be constructed under the Bou Regreg river at an estimated cost of MD1.4bn (US$140 million). The tunnel will connect the Sale and Agdal stations in an effort to alleviate traffic.

Similarly, the long-awaited Kuwait Metro will feature extensive tunnelling to navigate the dense urban fabric of Kuwait City, ensuring minimal disruption to existing roads while integrating with future transport networks.

Qatar’s expansion of Doha Metro, meanwhile, requires additional underground infrastructure to connect developing areas and support the country’s vision for a comprehensive public transport system.

Mecca Metro, already serving millions of pilgrims, is also set for further expansion, likely involving significant tunnelling to facilitate smoother access to holy sites while overcoming geographic constraints.

In Oman, the Muscat Metro project is likewise expected to link key districts while preserving the city’s landscape and avoiding disruptions to arterial roads by introducing underground sections.

All of these projects show that tunnels will play an important role in the region’s future as it strives to create cities with more efficient and environmentally sustainable transit and utilities systems.

By Yasir Iqbal

GLOBAL REGIONS: PROJECT PIPELINE SNAPSHOT

Middle East and North Africa (Mena)

The Mena region has a tunnel construction pipeline valued at US$128.6 billion. The UAE is one of the leading markets, with US$25.4 billion of projects that are mainly for metro systems and water and sewage tunnels. Across the region, economic factors like high debt and lower oil revenues may hinder the progress of these projects in the future.

Western Europe

Western Europe has a tunnel construction project pipeline valued at US$329.5 billion, with Switzerland leading with $60.6bn of projects, followed by Germany with US$56.8 billion. Notable projects include the Turin-Lyon tunnel. Projects in pre-execution and execution stages total US$222.8 billion, with the highest-value project being Zurich’s US$38.8 billion CST (underground cargo) Freight Metro Tunnel.

Northeast Asia

Northeast Asia’s tunnel construction pipeline is valued at US$327.7 billion, with China contributing US$220.3 billion, including the US$42.4 billion Dalian-Yantai undersea railway tunnel. Japan has projects worth US$101.3 billion, primarily the US$65.2 billion Tokyo to Nagoya Maglev Railway Line. Most projects are in later development stages, totalling US$198.3 billion, or 69.8% of the pipeline.

Australasia

Australasia’s tunnel construction pipeline totals US$150.1 billion, with Australia holding US$112.9 billion, about 75% of the region’s value. The largest project is the US$87 billion Melbourne Suburban Rail Loop, a 90km-long rail loop with 13 stations. Construction on six stations began in 2022, with the entire project expected to finish by 2050, though rising costs and labour shortages may affect this.

North America

North America’s tunnel projects are valued at US$92.4 billion, with US$63.6 billion in pre-execution and execution stages. The pipeline includes 921.8km of tunnels, primarily in the US. Railway tunnels are the largest segment at US$40.7 billion, with the Hudson River Rail Tunnel being the highest-value project at US$16 billion.

Southeast Asia

Southeast Asia’s tunnel pipeline is valued at US$91.3 billion, with US$55.1 billion under construction. Singapore leads with US$45.2 billion, mainly from rail tunnel projects. The Land Transport Authority awarded a US$199 million contract for tunnels connecting MRT stations as part of the Cross Island Line’s second phase.

Eastern Europe

Eastern Europe’s pipeline is valued at US$56.3 billion, with US$46.9 billion in pre-execution and execution stages. Major contributors include Turkiye, Czechia and Romania, which has the largest share at US$16.3 billion. The US$9 billion Bucharest metro Line 5 is a key project expected to complete by 2033, with spending projected to rise in the coming years.

South Asia

South Asia’s tunnel construction pipeline is valued at US$47.9 billion, with India contributing US$31.9 billion, primarily from road tunnels. A notable project is the US$1.3 billion Thane to Borivali tunnel. The pipeline includes 2,043.7km of developments.

Latin America

Latin America has a growing tunnel construction pipeline valued at US$30.3 billion, with US$28.7 billion in later development stages. The region includes 276.2km of projects, with Colombia leading at 92.1km. The highest-value project is the US$9.6 billion Bogota metro, which began construction in early 2021.

Sub-Saharan Africa

Sub-Saharan Africa’s tunnel construction pipeline is valued at US$6.7 billion, with 63.7% in pre-execution and execution stages. The pipeline includes 1,580km of projects, primarily in Tanzania, Ethiopia and Kenya. Spending may reach US$685 million in 2025, but investment constraints may limit new projects.

In conclusion, while the global tunnel construction industry faces challenges due to muted spending, high construction material prices and geopolitical uncertainties, significant infrastructure initiatives are expected to continue driving new investment.

By Colin Foreman